Click the event box to see the training dates for each event.

Tax Resolution Accelerator 2025

The ASTPS Tax Resolution Accelerator© is an engaging, expert-led, cohort based, live training program designed to help you confidently launch your new tax resolution career as quickly as possible.

Our Next Cohort is Launching June 18th!

Dates

Virtual Kickoff Session

June 18th | 11:00am – 6:00pm Eastern

Hybrid Main Event

June 24th | 10:00am – 6:00pm Eastern

June 25th | 10:00am – 7:00pm Eastern

June 26th | 10:00am – 5:00pm Eastern

Dates

Virtual Kickoff Session

Sept 10th | 11:00am – 6:00pm Eastern

Hybrid Main Event

Sept 17th | 10:00am – 6:00pm Eastern

Sept 18th | 10:00am – 7:00pm Eastern

Sept 19th | 10:00am – 5:00pm Eastern

Dates

Virtual Kickoff Session

Dec 4th | 11:00am – 6:00pm Eastern

Hybrid Main Event

Dec 9th | 10:00am – 6:00pm Eastern

Dec 10th | 10:00am – 7:00pm Eastern

Dec 11th | 10:00am – 5:00pm Eastern

Established 2003

The Fastest Way to Master Tax Resolution & Start Earning More—In Just 4 Days

The ASTPS Tax Resolution Accelerator is an intensive, hands-on training experience where you'll receive expert guidance from industry leaders who have helped countless tax pros build thriving tax resolution practices. This immersive program is designed to equip you with the skills, strategies, and confidence needed to take your tax resolution career to the next level—fast.

Register Now!Are you interested in Tax Resolution but not sure where to begin?

Tax pros are drawn to this program for a variety of different reasons. Maybe you can resonate with a few:

- Do you have a client with a tax problem and don’t know where to begin?

- Have you spent hours researching how to resolve an IRS issue on your own but were left feeling lost and frustrated?

- Do you have a client that you feel is being treated unfairly by the IRS and you’d like to learn how to defend their rights?

- Are you interested in learning a new skill that will help you earn higher fees using your existing credentials?

- Do you want to add a service to your firm that can bring in business year-round?

- Have you been dabbling in tax resolution but now you’ve decided to get serious?

- Do you want to make a real difference in the lives of your clients?

The ASTPS Accelerator is unlike any other tax training you’ve attended, this is your opportunity to walk away with actionable, personalized steps to tackle your biggest IRS representation challenges. You’ll be guided by top tax resolution professionals who have successfully resolved complex cases—just like the ones you’ll face.

This comprehensive program puts you in the trenches with real IRS cases so you can:

- Master tax resolution fast—in just 4 days

- Learn exactly how to win cases and get paid premium fees

- Walk away with the skills to start helping clients immediately

Decades of IRS Relief Expertise, Compressed into 4 Power-Packed Days

At ASTPS, we’ve spent over two decades mastering tax resolution. We’ve trained thousands of EAs, CPAs, and attorneys to:

- Take on even the toughest IRS cases with confidence

- Turn tax resolution into a six-figure (or more) revenue stream

- Deliver massive results for clients—and get paid what they’re worth

You don’t need years of experience to do this.

You just need the right system—and that’s exactly what we’ll give you.

- Live, Hands-On Training – Work through every aspect of IRS cases so you know exactly what to do when your first (or next) client needs help.

- Step-by-Step Case Blueprints – We hand you the exact process to resolve any tax issue, from liens to levies to installment agreements and beyond.

- Done-for-You Tools & Templates – Don’t reinvent the wheel. We give you the scripts, IRS forms, pricing guides, and client intake checklists you need.

- Direct Access to ASTPS Experts – Got questions? You’ll get live coaching and mentorship from the best in the business.

By the time you finish, you’ll be ready to take on real cases and start making money immediately.

Here’s What You’ll Experience at the Accelerator

Everything you need to know to launch a tax resolution career!

From client interview to IRS resolution acceptance here is overview of what you’ll know when you leave the Accelerator:

- Mastering IRS Representation – Learn the step-by-step process to confidently handle tax resolution cases from start to finish.

- Effective Case Investigation & Compliance – Discover how to pull, read, and analyze IRS transcripts, request FOIA documents, and get clients back into compliance.

- Crafting Winning Resolution Strategies – Develop tailored solutions using Offers in Compromise, Installment Agreements, Currently Non-Collectible status, and more.

- Handling Liens, Levies, & Collections – Navigate IRS enforcement actions, protect your clients’ rights, and negotiate the best possible outcomes.

- Mastering IRS Communication & Negotiation – Learn how to work effectively with Revenue Officers, ACS, and Appeals to advocate for your clients.

- Building & Managing a Thriving Tax Resolution Practice – Set up efficient workflows, manage client expectations, and deliver results that grow your business.

- Proven Marketing & Client Acquisition Strategies – Implement real-world techniques to attract high-value clients and establish yourself as a tax resolution expert.

Direct Access to Larry, LG, Steve, Ang, and the ASTPS Team

Every instructor you’ll learn from in the ASTPS Tax Resolution Accelerator is a seasoned expert who actively works in the field, handling real tax resolution cases every day. You’re not just learning theory—you’re getting proven strategies and insider knowledge from pros who are in the trenches, solving complex IRS issues just like the ones you’ll face.

Our interactive Q&A sessions ensure that you get direct, personalized guidance. Bring your toughest questions, and our team of experts will provide actionable advice to help you overcome challenges and fast-track your success in tax resolution.

- Live Q&A for Online Attendees – Participate in real-time interactive Q&A sessions, where dedicated instructors will answer your questions as the training unfolds.

- In-Person Access to Instructors – Engage with instructors before and after sessions, ask follow-up questions, and get personalized advice throughout the event.

- Exclusive Networking & Receptions – Meet instructors and fellow tax pros at our structured networking events and evening receptions, building relationships that last beyond the Accelerator.

- Comprehensive Q&A Reports – Both in-person and virtual attendees will receive a full recap of all Q&A discussions to reference even after the event

Join a Like-Minded Community

You’re not alone on this journey! With the ASTPS team by your side, you’ll join a community of like-minded tax professionals who are passionate about solving IRS problems and building thriving tax resolution practices.

You’ll collaborate with your cohort, working alongside professionals at all experience levels to exchange strategies, gain support, and accelerate your success. The learning doesn’t stop when the event ends—stay engaged through ongoing discussions, expert guidance, and valuable updates within the ASTPS network.

Plus, by connecting with fellow attendees, you’ll gain real-world insights from their successes and challenges, helping you refine your own approach to tax resolution.

- Exclusive Networking Reception – After the first day, in-person attendees are invited to a dedicated networking reception to meet fellow professionals and instructors in a relaxed setting.

- Optional Activity-Based Networking Event – Take your networking to the next level with an optional group outing, available for purchase, where you can bond with peers while enjoying a unique local experience—like a trip on the Maid of the Mist in Niagara Falls!

- Access to a Private Online Community – Stay connected with your cohort through our dedicated online community, where you can ask questions, share insights, and continue learning even after the Accelerator ends.

Also included in the Accelerator:

6 Hands-On Case Studies

At the ASTPS Accelerator you’ll get a real taste of what it’s like to work in this field by going through 6 case study exercises! These real-life situations enable attendees to understand the context, complexities, and nuances of a tax resolution case. Most importantly it helps them to see the practical applications of theoretical concepts.

Templates & Checklists

One of the hardest things to do is start with a blank screen. In the Accelerator you are going to get access to dozens of templates to get you up and running! Here is just some of what you’ll receive:

- Intake Sheets

- Interview Checklists

- Engagement Letters

- Penalty Abatement Requests

- Marketing Brochures

- Plus a lot more!

Flowcharts

In the Accelerator, you’ll get access to 16 different flowcharts to help you visualize the flow of different aspects of cases through the IRS! You’ll get flowcharts for the initial contact sequence, case management, non-filer cases, collection cases, and more!

About Our Tax Resolution Instructors

Most people aren’t lucky enough to have a single mentor with over 20 years of tax resolution experience to learn from. After you enroll in this program you’ll immediately have 4!

This is an expert led course – meaning each instructor you’ll hear from is an active tax resolution practitioner working cases daily. They’ll draw on their experience in the field to give you real world tips, strategies, and stories.

They’re also incredibly engaging and entertaining!

The fact is you’re considering investing a significant amount of time, money, and effort – boring instructors reading from slides likely isn’t going to do it for you…

Our instructors not only have an immense amount of tax resolution knowledge but they’re world class speakers. Each instructor has their own unique style which keeps things interesting.

Larry Lawler, CPA, EA, CTRS

Larry is the Founder & National Director of ASTPS and the architect of the Accelerator Program. He has worked and consulted on literally thousands of IRS representation cases and is a frequent public speaker, a writer on professional topics, and a regular trainer of tax professionals nationwide. He has been a New York CPA since 1973. He is also a fellow of the National Tax Practice Institute. Larry is the managing partner of Lawler & Witkowski, CPAs, PC, the firm he established in 1973.

LG Brooks, EA, CTRS

LG is the former CEO of U.S. Tax & Consulting Group and the current Senior Tax Resolution Consultant at Lawler and Witkowski CPA's as well as the Director of Education at ASTPS. LG is most well-known for his knowledge, energy, and passion in his presentations. He has been in the field of taxation for more than 30 years and has worked and consulted on thousands of tax resolution cases over the course of his career. LG is a Certified Tax Resolution Specialist and a Fellow of the National Tax Practice Institute.

Steve Klitzner, Esq., CTRS

Steve is the CEO of Florida Tax Solvers which is 100% focused on IRS Tax Resolution. Steve has presented at many ASTPS events in the last 10 years and is always a crowd favorite at the Accelerator. He is admitted to the US Supreme Court, US Tax Court, US Court of Appeals for the Fifth Circuit, and the US District Court for the Southern District of Florida. He currently sits on the IRS Advisory Council and is a frequent lecturer on Tax Resolution and has presented to thousands of practitioners around the country.

Angelene Wierzbic, EA, CTRS

Angelene has worked along side Larry Lawler since the minute she graduated college in 2004. She has since spent nearly two decades in the trenches working on complex tax resolution cases. During the Accelerator she will be teaching about eservices and will be in the background answering and coordinating your questions.

⭐⭐⭐⭐⭐

“I loved it! I love the family culture of the staff. Presenters were very informative and entertaining. Kept my attention the whole time. Also, you can tell they are passionate about what they do. Thank you all for a great experience!” – Garri G.

⭐⭐⭐⭐⭐

“I was honestly deeply touched by the level of respect and care that presenters showed to attendees… Big thank you to everyone in ASTPS team!” – Angie G.

⭐⭐⭐⭐⭐

“I enjoyed spending time with Larry, LG, Steve, and Mitch. You guys, and Carolyn, are like family in so many ways. ” – Mike L.

Format & Attendance Options

On-Demand Prerequisites

Length: 5 Hours

We have included a series of prerequisite trainings before the program begins to ensure you have the best possible experience at the ASTPS Tax Resolution Accelerator.

While optional, we highly recommend that you complete them. These foundational lessons are designed to elevate your readiness, giving you a strong grasp of essential tax resolution concepts and procedures so you can hit the ground running when the event starts.

Virtual Kickoff Session | Day 1

Length: 7 Hours

The event officially begins with the virtual kickoff session on Zoom, where we get right to work!

This session is virtual for all attendees and is not a “testing” or “onboarding session.” We’re diving head-first into the training. We’ll be covering topics such as Getting Transcripts, IRS Notices, Statutes of Limitations, and more.

If you must miss this section it is highly recommended watching the replay before the start of the main event!

Hybrid Main Event | Days 2-4

Length: 24 Hours

After the kickoff, attendees move into the Main Event, a 3-day immersive training block. Here, you have the choice to:

- Attend In-Person – Join us at one of our designated event locations for a live, hands-on classroom experience with direct access to instructors and networking opportunities.

- Attend Virtually – Participate from anywhere with our interactive live-streamed sessions, ensuring you receive the same high-quality instruction and the ability to engage with instructors and classmates.

We are so confident that you will be 100% satisfied with our program that we are willing to give you a FULL REFUND if you are not! If after the Virtual Kickoff Session, you do not feel like this program is right for you, simply return your materials and we will refund your registration fee.

Accelerator Enrollment Recap

The ASTPS Accelerator is regularly $1,697 and prices displayed below reflect the “Super Early Bird Pricing.” This pricing may or may not be available depending on when the event starts and the current date. Please check the individual session page for the current pricing.

- 27 Hours of Live Tax Resolution Training – Gain in-depth knowledge through a comprehensive curriculum designed to help you master IRS representation in just four days.

- Samples, Forms, and Templates – Access professionally crafted templates, checklists, and engagement letters to streamline your workflow and ensure accuracy in every case you handle.

- Approved by the IRS & NASBA – Earn Continuing Education credits recognized by both the IRS and NASBA

- Attend virtually or in-person – Choose the learning format that best fits your schedule and preferences

- 6 Hands-on field training exercises – Work through real-world case studies that simulate actual tax resolution scenarios

- Unlimited Q&A – Get direct access to expert instructors who will answer all your questions in real-time

- Network with like-minded tax pros – Connect with 150 professionals in your cohort, building relationships that can lead to referrals, partnerships, and long-term success.

- 3-month access to recordings – Revisit key lessons and refresh your knowledge at your own pace

- 100% Money Back Guarantee – Enroll with confidence knowing that if you’re not completely satisfied after the first stage, you can receive a full refund—no questions asked.

Program Pricing

The ASTPS Accelerator is regularly $1,697 and prices displayed below reflect the “Super Early Bird Pricing.” This pricing may or may not be available depending on when the event starts and the current date. Please check the individual session page for the current pricing.

Become a member before registering and receive 15% off!

100% Money Back Guarantee

We are so confident that you will be 100% satisfied with our program that we are willing to give you a FULL REFUND if you are not! If after stage 1, you do not feel like this program is right for you, simply return your materials and we will refund your registration fee.

Previous Boot Camp or Accelerator Attendee?

The bones of the Boot Camp are in the Accelerator, along with 12+ hours of new and expanded content! Both previous Boot Camp and Accelerator attendees will be able to attend at 50% off the regular price which is now $748.50 for life!

Registering 3 or more people?

If your firm is looking to get 3 or more staff members trained there are additional discounts available. Please contact ASTPS at (716) 630-1650 for registration.

⭐⭐⭐⭐⭐

“This was an amazing course! I have been doing tax resolution for 16 years. This is the best course for this material and the most relevant to my work, that I have experienced. Thank you so much!” – Beth E.

⭐⭐⭐⭐⭐

“This Accelerator program is exactly what is needed not only for those just starting in the tax resolution services but also greatly benefits those who are already in this type of service. Thanks for the great presentations.” – Guadalupe M.

⭐⭐⭐⭐⭐

“This was an incredible series. The value of what we received these weeks was amazing – the sessions and the physical handouts and items provided and support. It is without question the best organized training I’ve ever been to. And I plan to attend again!” – Christy N.

Click the event box to begin registration in that cohort.

Dates

Virtual Kickoff Session

June 18th | 11:00am – 6:00pm Eastern

Hybrid Main Event

June 24th | 10:00am – 6:00pm Eastern

June 25th | 10:00am – 7:00pm Eastern

June 26th | 10:00am – 5:00pm Eastern

Dates

Virtual Kickoff Session

Sept 10th | 11:00am – 6:00pm Eastern

Hybrid Main Event

Sept 17th | 10:00am – 6:00pm Eastern

Sept 18th | 10:00am – 7:00pm Eastern

Sept 19th | 10:00am – 5:00pm Eastern

Dates

Virtual Kickoff Session

Dec 4th | 11:00am – 6:00pm Eastern

Hybrid Main Event

Dec 9th | 10:00am – 6:00pm Eastern

Dec 10th | 10:00am – 7:00pm Eastern

Dec 11th | 10:00am – 5:00pm Eastern

Unlike other programs that have popped up in recent years to capitalize on the trend of tax resolution training, ASTPS has been running tax resolution trainings for two decades! The ASTPS Accelerator evolved from the long standing Boot Camp and is another example of the ASTPS commitment to constant improvement based on the feedback of our attendees.

Click the button below to take a look at what over 700 of your professional colleagues had to say about their experience!

“I really enjoyed this program. I brought 8 employees with me because I knew that this program was the best avenue for them to learn, and it worked – they have learned so much and are excited to use their new knowledge!” – Susan Taft

“I would highly recommend this program to any practitioner, old or new. Whether you have been practicing for over 13 years like I have, or are brand new to tax resolution, there is something to learn which translates into something you can earn! Thanks Larry & LG.” – Mike Wallen, EA

Continuing Education

At the ASTPS Accelerator, you will receive hands-on training by Certified Tax Resolution Specialists eligible for 27 hours of Continuing Education in the field of taxation.

ASTPS is accredited by NASBA (for CPAs), the IRS (for Enrolled Agents), and attorneys are more than welcome to submit the credits to their state bar for credit. We will happily provide you with whatever supporting documentation is required for submission!

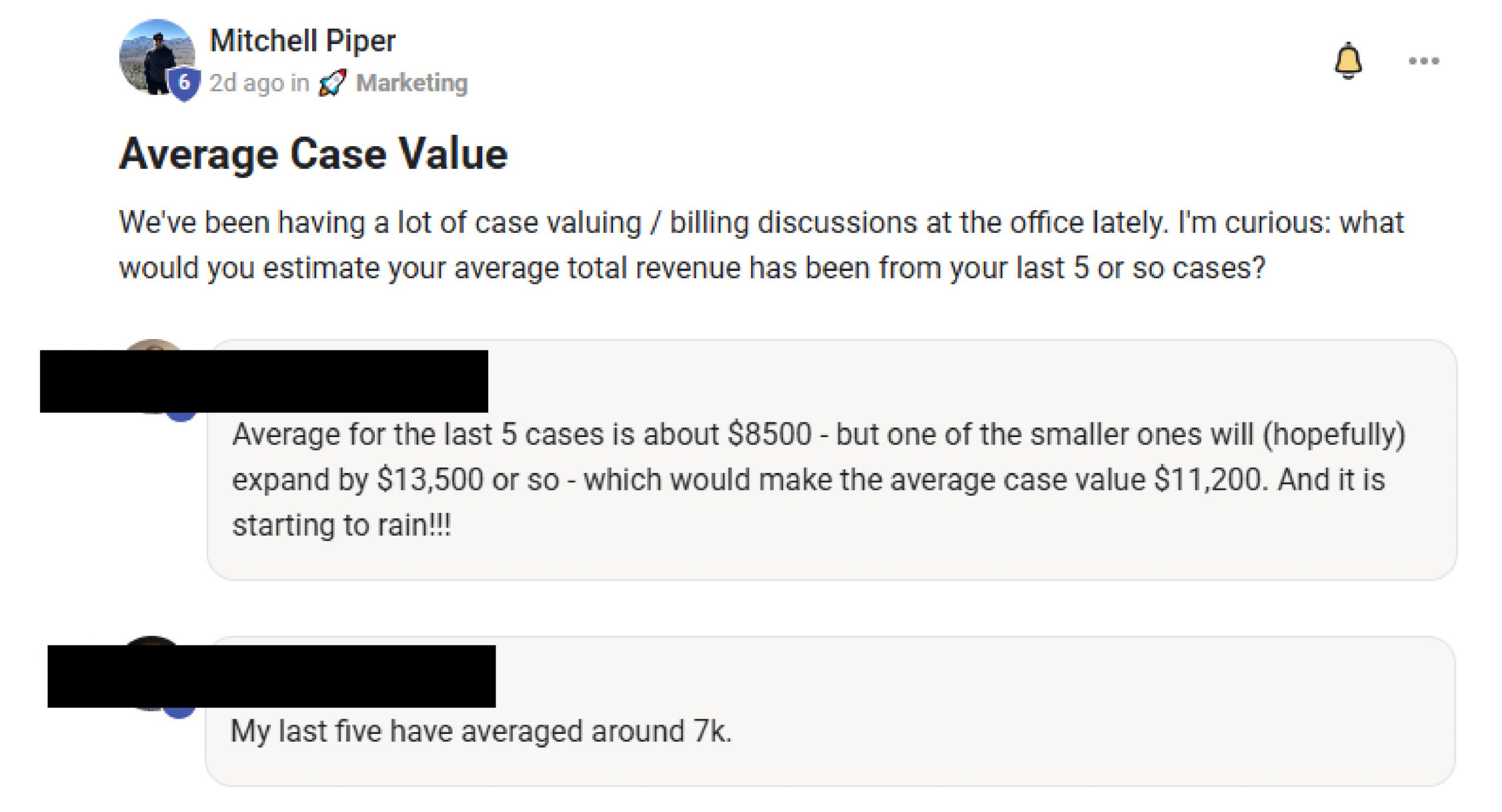

One Case Could Pay for This Entire Program—And Then It’s All Profit

Ok, so the question on your mind probably is, is it worth $1,497 to attend this program?

Our Answer: Absolutely (obviously)

Here’s why:

- The average tax resolution case value in our instructor’s firms is $3,500 – $5,000 (and that’s just the starting point).

- Many of our students charge $5,000+ per case after learning our pricing strategies.

- One case could cover the cost of this training—and then every case after that is pure profit.

The sooner you complete this training, the sooner you can start offering tax resolution with confidence.

What Does Billing Look Like in a Tax Resolution Case?

Let’s say a client comes to you and says:

“I haven’t filed tax returns for the last 3 years, and the IRS says I owe $45,000.“

We bill in two phases—Investigation & Compliance (Phase 1) and Resolution (Phase 2).

Phase 1 Example:

- Power of Attorney – $100

- Pull Transcripts (3 Years) – $300

- Prepare Tax Returns (3 Years) – $1,050

- Evaluation of Alternatives – $1,325

Total for Phase 1: $2,775

Now, let’s say your financial analysis shows the client can afford a monthly payment plan with the IRS, so you set up an installment agreement through ACS.

Phase 2 Example:

- Installment Agreement – ACS (under $50,000 liability) – $1,200

Total Fee for Case: $3,975

Now let’s address the elephant in the room:

“How is someone with tax problems going to pay my fees?”

Simple. At the Accelerator, we teach you exactly how to quote fees and structure payments so that the IRS helps cover them.

What is cohort based training?

A cohort-based course is a program of learning that’s organized according to a syllabus and is taken by a group of students (a cohort) at the same time. Each year there are 3 cohorts for the Accelerator! The training is exactly the same for each cohort.

How much does this cost?

With the average fee earned during a tax resolution case being anywhere from $3,000 – $5,000 this course could, and probably should, cost $6,000-$10,000. After all, you’re learning specialty skills that you can use for the rest of your career! Ultimately though our mission at ASTPS is to develop as many capable IRS representation experts as possible and to do that we need to keep the program as accessible as possible.

The full price of the course starts at $1,697 and gets lower with member and early bird discounts.

What does it mean that this is a hybrid program?

Hybrid is referring to how this program can be attended. The Virtual Event Kickoff will be virtual for everyone on Zoom. The Hybrid Main Event can be attended either in-person (in one of the 3 cities), or it can be attended virtually as well.

I've been before should I come again?

We have always recommended coming back and attending again after you’ve gotten some more tax resolution experience. Attendees often tell us it’s like watching a movie for a second time – you notice and pick up on new things you missed the first time around. Previous Boot Camp and Accelerator attendees will be able to attend at 50% off the regular price which is now $748.50.

Can this really work for me?

You might be thinking… sure this might work for other people, but my situation is unique. Over 5,000 tax resolution pros from all walks of life have launched their careers with ASTPS.

We are confident that there is no other single program that can better prepare you to start your tax resolution career. In fact we’re so confident that we have a 100% money back guarantee!

What if I've never talked to the IRS before?

Then the Accelerator is the place for you! This program is designed to show you everything you need to know to get started in tax resolution. We take you through the entire tax resolution process from gathering information to closing the case and answer every single one of your questions along the way!

What if I've handled a couple of cases - Is it worth taking this course?

For the most part having some experience is going to allow you to get even more out of the program. When you’re starting from scratch you don’t know what you don’t know. When you’ve gone through the process of working with the IRS you know what you struggled with. This course will give you best practices to drastically improve your processes. From former IRS professionals to tax pros with 20 years of experience – We’ve never had anyone tell us that they didn’t learn something worth the cost of admission!

How much access will I get to the instructors?

Whether you are attending online or in-person you will have full access to the instructors. While you are in-person you will be able to hang out with the instructors before class, on breaks, during the scheduled networking events and more! Online attendees will have full time instructors dedicated to answering their questions as well! If applicable to everyone your questions will also be read out loud for the entire class to hear. Bottom line what sets ASTPS apart from everyone else is the caring, kind, knowledgeable instructors!

Do I need to attend all of the stages in real-time?

In order to ask questions and get continuing education you must be attending in real-time whether it is in-person or virtually online. Recordings will be available for 3 months, but to get the most out of your experience you should plan on participating live.

How long do I have access to the course materials & recordings?

You will receive printed materials with all of the presentation slides along with the Field Training Exercise handouts. All other material will be delivered digitally. You will have access to the recordings of the event for 3 months to review after the conclusion of the event. Additionally, you will now be able to get 50% off the Accelerator for life!

Do I need to be licensed to enroll in this program?

Anyone can take this program but you do need to be a licensed CPA, EA, or Attorney to represent before the IRS. We do very often have practitioners in the process of getting their Enrolled Agent license take this course. We also get practitioners who want to send their unlicensed support staff for training.

If you’re all the way down here, and still reading, you might be on the fence if this is really worth it.

It’s no secret that there are tons of free training webinars out there (we even do one every month). And sure in time you could probably stich together some of what is included in the Accelerator for free.

You could continue dabbling in tax resolution and learn as you go, but let me caution you. There are processes, procedures, deadlines, and what you don’t know CAN hurt your client.

Even small mistakes can lead to your client paying thousands, or even tens of thousands, of dollars more than they should.

The ASTPS Accelerator is designed to teach you everything you need to know to get started in tax resolution. Basically the Accelerator, well, accelerates you. You will build a solid foundation to launch your career and start miles ahead of your competitors that choose to dabble and learn on their own.

Is it really possible for a tax program to change your life? Truthfully the answer is yes! I say that because we’ve seen it so many times over the years. We’ve seen people launch businesses, and quit their 9-5 jobs. We’ve seen attendees land their dream jobs with their newly acquired skills. We’ve seen partnerships formed and life long friendships that all started at this program.

If you put in the work, this course has the potential to change the trajectory of your career and life.

And it can all start right here, right now.

What makes ASTPS different?

The American Society of Tax Problem Solvers is different from every other organization. We move fast, we listen to our members and attendees, we’re obsessed with improving, and most of all we sincerely care.

When picking an organization to be a part of it’s critical to consider the leadership. Many other programs feature instructors that do not actively represent before the IRS or who clearly are just in it for the money. Sadly there are even whole events out there where the only goal is to teach you what to do, and not how to do it. That’s because they are looking for you to refer cases to them, not do the work yourself.

All of the Accelerator presenters independently created tax resolution practices from scratch. You also may have noticed that all 3 of them come from different professional backgrounds, and are from different areas of the country! Larry Lawler is a CPA in Buffalo, LG Brooks is an Enrolled Agent in Dallas, and Steve Klitzner is an Attorney in Miami.

We don’t want your cases (we all have plenty of our own). All we want is for you to be successful. Of course until you get to know us you’ll have to take our word for it! For most people seeing is believing and that’s why we let you try this course 100% risk free!

100% Money Back Guarantee

If after the Virtual Kickoff Session you don’t think this course is right for you, for any reason, you can return the material for a full refund. You have absolutely nothing to lose, and we hope you decide to join us!

⭐⭐⭐⭐⭐

“Worth every penny. Presenters give you the knowledge and tools to school the revenue agents/IRS!” – Shakirat Olanrewaju, CPA

⭐⭐⭐⭐⭐

“Coming into this program I had little knowledge of the area. After the Boot Camp I can’t wait to take on my first case. This Boot Camp has given me the confidence I needed to move toward a tax representation career.” – Sarah Staab

⭐⭐⭐⭐⭐

“This seminar was the key to the tax resolution castle. Now I feel more comfortable in understanding the tax collection process and how to help clients answer their tax relief prayers.” – Ron Friedman, CPA

⭐⭐⭐⭐⭐

“I found the lecturers to be knowledgeable and extremely entertaining – it made the days go by quickly.” -Yawar Jafri, EA

⭐⭐⭐⭐⭐

“The networking session provided a great opportunity to meet other professionals and discuss how to resolve real client’s issues.”- Iris I. Burnell

⭐⭐⭐⭐⭐

“I have spent 4 years attending live NAEA seminars to receive my NTPI fellow. I think I’ve learned more this week than I have in those years at NTPI. I will be back.” – Marilyn Mathis, EA

⭐⭐⭐⭐⭐

“Both Larry and LG are PHENOMENAL presenters.” – Vonda Bowens

⭐⭐⭐⭐⭐

“3rd year in a row I’ve been here and every year I learn a little more, and understand the material more. It’s great!!” – Robert Lewin

⭐⭐⭐⭐⭐

“Very well done. Worth the time and investment.” – Tim Reed

⭐⭐⭐⭐⭐

“Great program – learned valuable information which will help working with the IRS. Great presenters with a wealth of knowledge.” – Ron Mermer

⭐⭐⭐⭐⭐

“I have been looking for this type of seminar to learn more about tax resolution. I would recommend it to others.” – Eakub Khan

⭐⭐⭐⭐⭐

“Practical information for someone new to representation – definitely a confidence builder for this type of work! Great for not only explaining the info, but showing how they work in practice.” – William Deighan

⭐⭐⭐⭐⭐

“The instructors were exceptional; they’re passionate and experienced with IRS topics.” – Juan Diaz

⭐⭐⭐⭐⭐

“This course is a confidence builder and a source of motivation.” – Anthony Modica

⭐⭐⭐⭐⭐

“I spent 30 years building a tax practice with no mentor, I wish I would have had this advice 30 years ago.” – Katherine Gilbert

⭐⭐⭐⭐⭐

“I would highly recommend this program to any practitioner, old or new. Whether you have been practicing for over 13 years like I have, or are brand new to tax resolution there is something to learn, which translates into something you can earn! Thanks Larry & LG” – Mike Wallen, EA

⭐⭐⭐⭐⭐

“Absolutely loved the Boot Camp! Presenters were awesome and professional! I would definitely recommend this program to my colleagues.” – Aleksey Kaplan

⭐⭐⭐⭐⭐

“I feel like I can go forward with this business segment now. Still a lot to learn, but now I know where to look for answers.” – Caryn Thompson, CPA

⭐⭐⭐⭐⭐

“No other program that I am aware of that better prepares a tax professional to immediately gain the knowledge and confidence needed to enter the tax resolution business.” – Warren Banfield

⭐⭐⭐⭐⭐

“Excellent, effective presentation. Good real life examples.” – Gary Soltys, CPA

⭐⭐⭐⭐⭐

“Very informative and comprehensive. I have learned more than enough to assume my new tax resolution position.” – Adriano Pantino

⭐⭐⭐⭐⭐

“Enjoyed the presentation very much. I learned a lot that I will use in my practice.” – Nicholas Gebelt, ESQ.

⭐⭐⭐⭐⭐

“A great learning experience. I especially enjoyed LG’s enthusiasm and professionalism” – Lillie Mae Hubbard, CPA, ESQ.

⭐⭐⭐⭐⭐

“Great program – very informative, perfectly-paced, and a nice mix of hands-on case study and lecture.” – Joe Beige

⭐⭐⭐⭐⭐

“Great energy, professional & fun. Practice cases were a big plus.” – Ron D’Abrosca

⭐⭐⭐⭐⭐

“Excellent format, and the tag team between instructors is very easy to listen to.” – Timothy Anderson

⭐⭐⭐⭐⭐

“Program is very informative. I have come multiple time to get updates on what is going on in the industry and keep up to date.” – David Rappaport

⭐⭐⭐⭐⭐

“Thoroughly enjoyed the program. So happy to have found ASTPS.” – Patricia Rivera

⭐⭐⭐⭐⭐

“The speakers were amazing, kept us interested and attentive with their style of teaching, and also all very knowledgeable.” – Randall Guido

⭐⭐⭐⭐⭐

“I feel like I have found the key to the black box of collection procedures and methods of dealing with them.” – Howard Sang

We get it; this is a big investment, and you want to make the right decision!

We’ve been working on this program for nearly 20 years, and every year we take the feedback and make the next version even better. So, where do we go from here?

Click the button below to take a look at over 700 more reviews from your professional colleagues. If that’s not enough, click the button below that one to check out nearly 500 more reviews of ASTPS.

Still not enough? Email Info@astps.org, and we’ll send you even more that we haven’t had a chance to publish.

PS – Don’t forget we have a 100% money-back guarantee!