Presented by the American Society of Tax Problem Solvers.

Advanced Webinar Series

Get ready to master:

Aggressive Planning For Troubled Taxpayers With Assets & Income

Tuesday, Oct 29th | 1pm-4pm Eastern

Participants will earn: 3 CPE/CE credit

Field of Study: Taxation

Webinar Platform: Zoom

Handout Material: Delivered Virtually

Event Recording: Yes, 12 Month Access

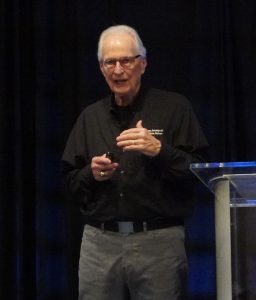

Presented by: Larry Lawler, CPA, EA, CTRS

Presented by: Larry Lawler, CPA, EA, CTRS

Larry is the Founder & National Director of ASTPS and the architect of the Accelerator Program. He has worked and consulted on literally thousands of IRS representation cases and is a frequent public speaker, a writer on professional topics, and a regular trainer of tax professionals nationwide. He has been a New York CPA since 1973. He is also a fellow of the National Tax Practice Institute. Larry is the managing partner of Lawler & Witkowski, CPAs, PC, the firm he established in 1973.

“I always feel like I’m learning from a Jeddi master with Larry. Gets us into the right mindset, logically deals with the relevant issues, gets us outside of the box to look around. All with real-life examples and anecdotes. I feel like I know where to start now and what direction to go

“Thanks Larry, Time well spent. I certainly did add to my tax resolution toolbox!” – Steven P.

“Excellent as usual. I have successfully employed some tactics covered but still picked up ideas and nuances to further improve my efforts. Thanks!” – Ronald H.

3 Hours of Tax Resolution Training

More knowledge = More Profit

It’s simple – The more you know and understand about tax resolution, the quicker and more efficiently you can work cases. This should result in more profit per case!

Confidently Represent

What was once difficult eventually becomes routine. As you gain confidence in your tax resolution abilities you can command higher fees and increase your capacity to take on work. More clients means more revenue.

Learn from Experts

If you’ve decided to commit a major part of your career to tax resolution you don’t have to reinvent the wheel. By ordering a program like this one you are going to learn best practices from seasoned professionals.

Member Discounts Apply

Membership discounts apply to this program. 15% for Premium members and 5% for Standard members.