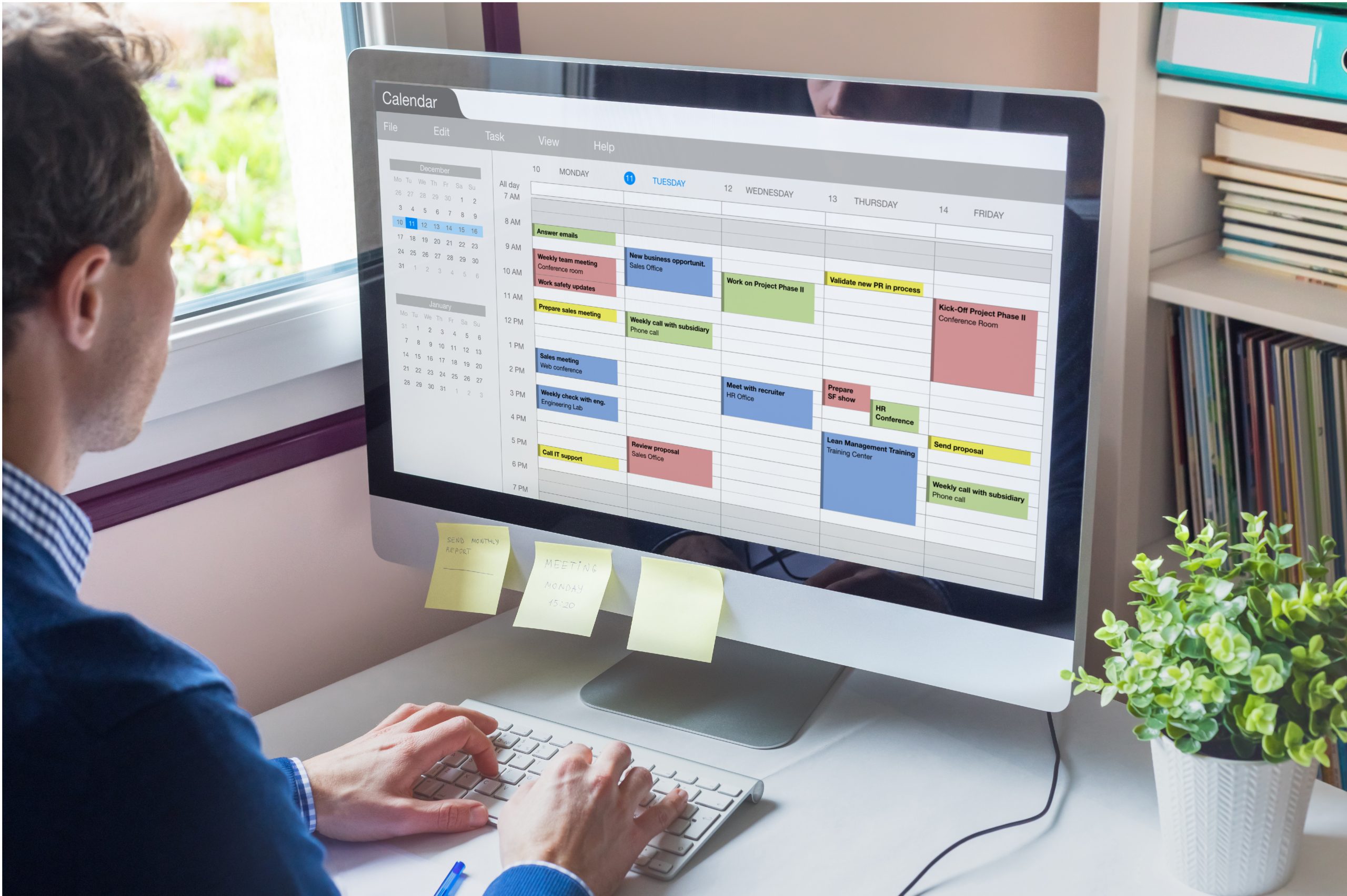

With a new administration in the White House, shifts in priorities at the IRS are inevitable. Efforts to streamline the government—including reductions at the IRS—mean taxpayers will likely face longer wait times, diminished customer service, and growing frustration. At the same time, the IRS is ramping up its use of technology, which could lead to more automated enforcement actions and fewer opportunities for taxpayers to resolve issues with a human representative.

For tax professionals, this evolving landscape presents both challenges and opportunities. To stay ahead, many are expanding their service offerings and strengthening their expertise to remain competitive in an industry that’s constantly in flux.

Tax resolution stands out as a powerful solution. It seamlessly integrates into existing tax practices, provides a solid foundation for new firms, and enhances your value in the marketplace.

At ASTPS, we specialize in equipping tax professionals with the knowledge, tools, and confidence to master tax resolution. Whether you’re looking to diversify your practice, take on more challenging cases, or establish yourself as a go-to expert, we’re here to support you every step of the way.